Do you realise that your personality type is critical to your initial and ongoing capacity to invest? It’s so close to home, yet it’s one thing we overlook (or choose to).

Maybe I should distinguish between personality and temperament.

What we all see is your personality: it’s the face you put on. But your temperament is what you are underneath.

I first learned this in the book Personality Plus by Florence Littauer – a delightful author whom I actually met at a seminar 30 years ago. Reading it made me realise how important it was to understand our inner selves, as she writes:

“Know what what we’re made of

know why we react as we do

Know our weaknesses and how to overcome them.”1

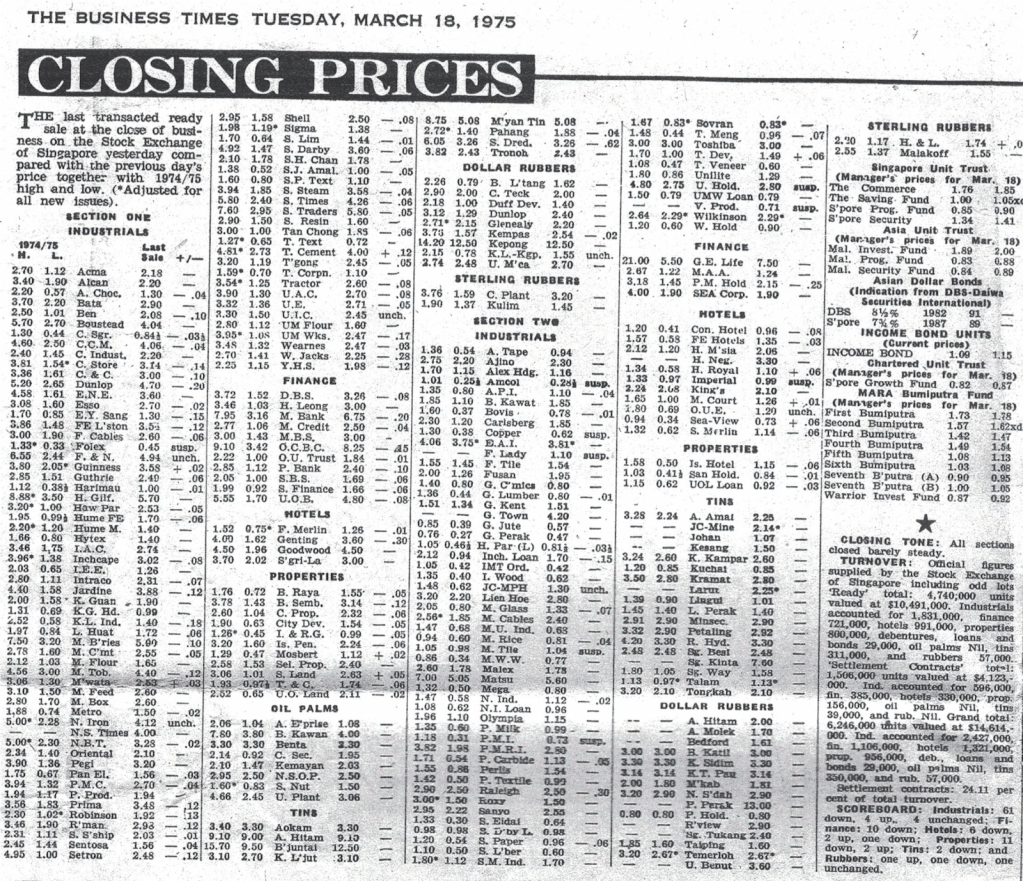

This jazzy, fun chart compares the 4 temperaments we apparently have:

Similar to the chart, Littauer says:

- The sanguine’s “optimistic, cheerful and bubbling”

- The melancholic’s “analytical, detailed, perfectionist”

- The choleric’s “adventurous, confident, productive”

- The phlegmatic’s “patient, obliging, consistent, laid back”.2

Decide which temperament you are – but you could be a mixture of them!

Littauer also gives us a very thorough checklist of strengths and weaknesses to determine our dominant and less dominant personality traits. Please get her book if you can (it’s had numerous reprints).

So it’s quite clear that by understanding ourselves, we learn to understand others – so important in business and personal relationships. But it’s especially important in INVESTING, where your temperament is key to your ability to make right decisions.

TIP: Want to be successful? Work on your weaknesses and enhance your strengths!

My dear Dad, in his innocence, knew this. He matched stock recommendations with what he called his clients’ “moods”. Here’s one example.

A wealthy, well-known lady – we’ll call her ‘Patsy Leow’ – used to frequent the Singapore Turf Club in the old days. She loved picking ‘outsiders’3 – but most of her money went on horses with short odds, or ‘favourites’.

When Madam Leow asked Dad for his share tips, he chose those “that will never go down” – solid companies with increasing yearly profits and paying healthy dividends. He also told her of 2 or 3 shares he liked that were “cheap now but had lots of potential to go up in price”. Her eyes lit up and she said, “Yes, Alex, we’ll put a few thousand on those!”

Such speculative stocks kept Madam Leow interested: she liked the challenge and excitement in picking a winner that would eventually pay well, and she came back for more.

So for all you optimistic choleric and sanguine risk-takers – who enjoy a good punt and love to talk about your wins, ‘speckies’ have great appeal, and you’ll likely go this way.

But worrying melancholics and laid-back phlegmatics amongst you should invest conservatively, limit borrowings and stick to topping up superannuation, investing in property, managed funds, and ETFs or LICs (see Invest 3.0). Such options will suit you perfectly without the compulsive need to check your stocks several times a day!

In the past, worriers bought “solid” shares which they could “lock up and keep for their children”. It worked well 20 years ago, especially for the banks, but not now.

I also recall a manager of the Hongkong and Shanghai Bank pointing to me when I was 8 and saying to Dad: “If you love your daughter, buy her HSBC shares!” My father did more than that – he also bought shares in Standard Chartered Bank, and told his clients to do the same.

TIP: Banks are no longer stockmarket darlings. ‘Fin-techs’ – a common, current term – relate to digital financial products like ‘Blockchain’. This is looming to weaken dominance of the Australian ‘Big 4’. It’s time to look for other dividend-paying stocks with growth potential.

My personality, my formula

My personality without a doubt influences the shares I buy. But it’s a little more complex. I believe I’m mainly sanguine with a little of the choleric, melancholic and phlegmatic thrown in.

I love excitement. I’m a risk-taker. I love the unexpected. But at the same time, I’ve learned to be patient and cautious.

My strategy over the last 40 years was to slowly build my portfolio up to about 30 stocks, and sometimes more. This roughly comprises:

- 50% per the ‘IPD’ formula (see Invest 1.0) that tick boxes of income, profit and dividends

- 30% into ‘growth’ stocks with healthy revenue (ie. income before expenses), but haven’t yet made a profit (ie. income after expenses)

- 20% in reserve for stocks with ‘potential’ – but I don’t invest more than $1000 on those. While no-one wants them today, I’m thinking long-term for up to 3 years.

My advice

- Don’t get caught by the FOMO (Fear Of Missing Out) – it’s dangerous!

- Assess how much you can invest. Never, never, never over-borrow to buy shares. When the market dives, you’ll still sleep well. The good news is markets always recover. If you’ve invested wisely, your money’s safe. People who’ve told me, “I’ll never buy shares again!”, are those who were bitten by the FOMO bug. They lost their money, their pride, but worse, missed opportunities yet to come.

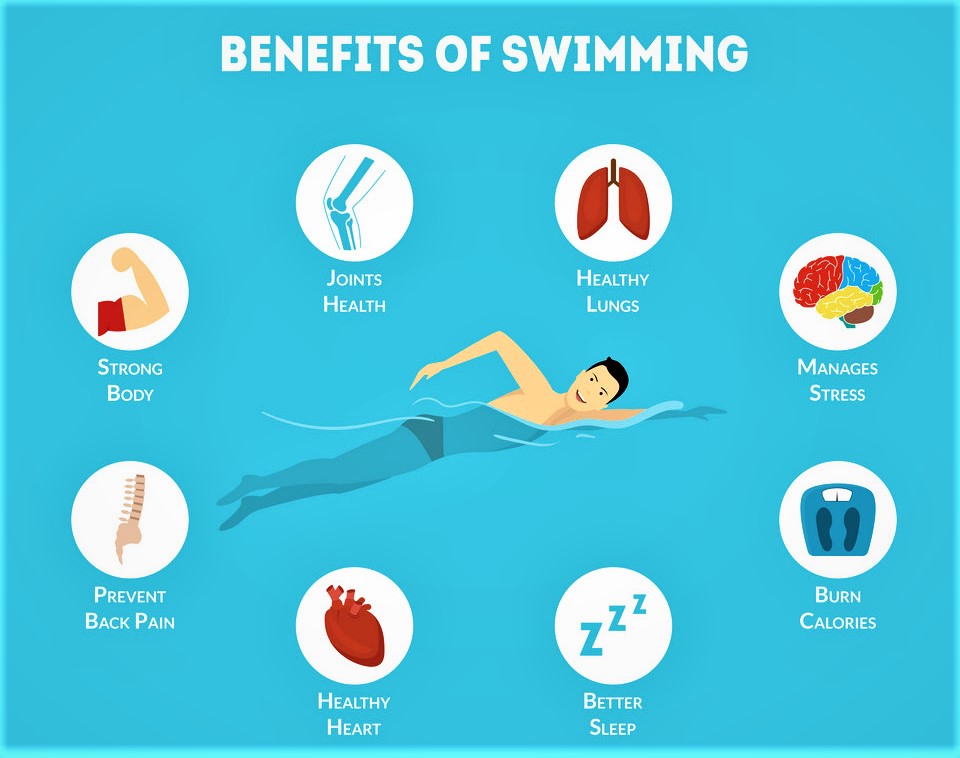

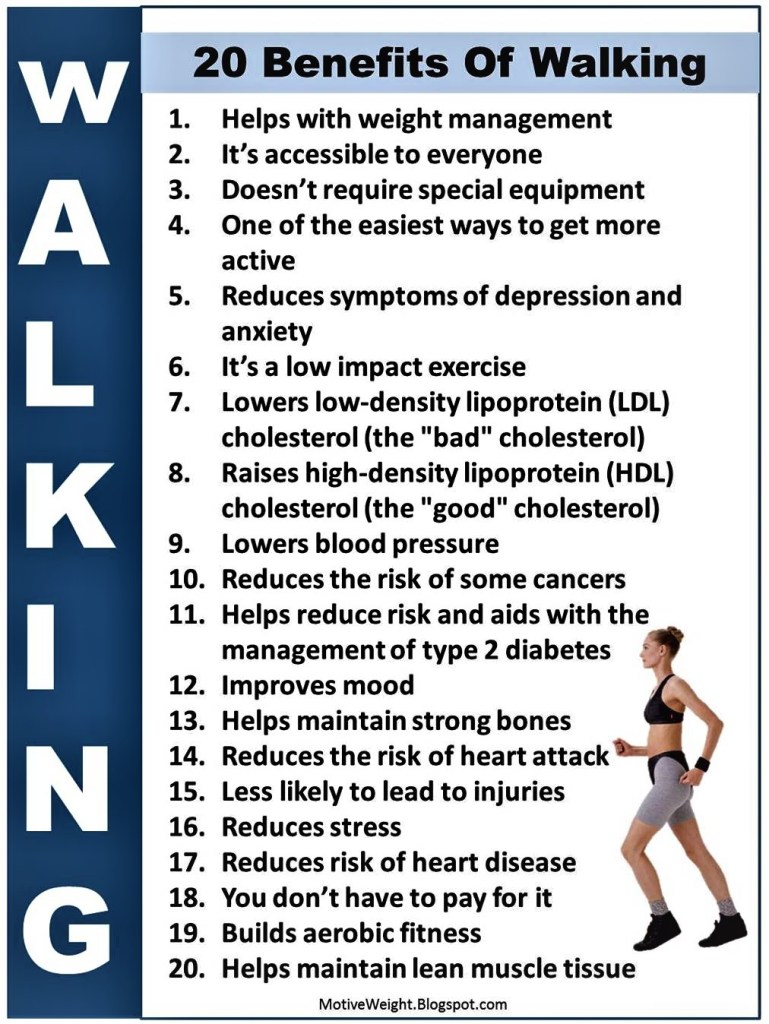

TIP: Be patient. There will ALWAYS be a good time to buy. Keep saving and make sure you’re mentally, physically and financially ready to ride the next wave. Happiness isn’t having money, but peace of mind and sleeping well at night.

What should you invest in?

- For those about to retire, my best advice is to top-up your superannuation to the max while you’re still working. If you want to have a go and have a spare $1–5K, get Telstra (TLS) and another newish Telco I’ve heard good things about: Aussie Broadband (ABB). TLS has a decent and fully franked dividend. (I hold parcels of Telstra and BDA, I’m watching ABB and may buy soon.)

- Want some fun? There are 2 (shock, horror) marijuana stocks you could pick: BOD Australia (BDA) and Althea Group Holdings Limited (AGH). Prices as of 5 July 2021 are 0.37 cents and 0.35 cents respectively. I believe you’ve a fair chance of making a profit in a year. I hold parcels in both shares.

- If you’re not ready to start an online trading account, the ASX website is excellent. You can create your watchlist and monitor and research stocks. It also runs several information sessions throughout the year.

- Worriers should go for managed funds or ASX-listed investment companies (LICs). I’ll give you the ASX codes for some LICs and leave you to research them. Pick 1 or 2 and don’t look at their prices for a few years:

– AFI

– ARG

– WAM

– WGB

– WMI.

You can see that I find all this very thrilling and engaging – I hope you also do by now! That risk element is the motivation we all need to keep us researching, observing and asking questions.

I’ll share my vision for the future with you in Invest 6.0.

1 Littauer, F. (1992). Personality Plus, p.12. Grand Rapids, Michigan: Baker Book House Company.

2 Littauer, p.19.

3 What we call ‘long shots’ or ‘roughies’ – ie. horses unlikely to win.

4 Stockbroker-speak for companies presently sitting in a corner waiting for someone to ask them to dance. Will they eventually take to the dance floor? In my experience, even when only 1 or 2 of them did, I more than made up for those that packed up and left!